Crispin Murray: Two key issues for Aussie stocks

Here’s what’s driving Australian equities this week according to Pendal’s head of equities Crispin Murray (pictured above). Reported by portfolio specialist Chris Adams.

- Crispin Murray names the big policy shifts driving equities

- Find out about Pendal’s Focus Australian Share Fund here

WE CONTINUE to see two key issues for markets following a relatively quiet news week in Australia and the US.

First is the divergence in Covid cases between developed and emerging markets. This could potentially lead to a constrained re-opening, negatively affecting the outlook for global cyclicals.

The second issue relates to the bond market and whether Covid case levels act as a handbrake on the recovery. At the moment economic growth concerns are holding bonds at lower yields and driving rotation back to defensives and growth stocks.

We share concerns that a broad re-opening will happen later than many think – and this could affect the outlook for specific stocks.

But we don’t believe this will stop a sharp acceleration in global growth while the Covid situation continues to improve in the US, EU and China. Receding fears in those regions should encourage yields back towards the 2% level.

Equities should remain supported and in decent shape in this environment. But a number of factors suggest a period of consolidation is likely.

Biden’s capital gains tax announcement prompted some sticker shock. But fears faded on the realisation that there’s a long way to go in terms of eventual outcomes.

The S&P/ASX 300 was down 0.03% last week. The S&P 500 lost 0.11%.

Covid and vaccines update

A spike in Indian cases reminds the world of Covid’s ability to spread exponentially in certain conditions. There has also been a deterioration in developed countries such as Japan and Canada.

This highlights the risk that we will see a two-tier global economy based on access to vaccines. Beyond the human and health implications, this could constrain the global recovery, putting pressure on commodities such as oil and underpinning the fall in bond yields.

There is some positive news out of the EU, where new cases have begun to decline. A recent upturn in the US has also rolled over.

We have not seen a significant wave develop outside of Spring break, rolled-back restrictions and the rise in cases in Michigan. New US cases are down 11% week-on-week and hospitalisations are 3% lower.

There is a view building that the US is getting close to herd immunity. Some 42% of the population has had at least one shot — the threshold at which cases started dropping significantly in Israel.

This includes 54% of the adult population and 80% of the most vulnerable segments. About a quarter of the US population has been previously affected and there is evidence that children (a material part of the unvaccinated portion) are less likely to spread the virus.

Excess vaccines is an issue to watch as the US program begins to slow.

In the past week vaccinations fell from 3.6 million per day to 3.3 million. This was partly due to suspension of the Johnson & Johnson vaccine, but we also saw a 12% drop in the number of Moderna vaccines administered.

This rate should recover as Johnson & Johnson becomes available again. But surveys suggest that the roughly 60% of Americans who actively want the vaccination should have received at least an initial dose by mid-May.

We then need to watch what happens with Americans who want to wait and see (about 20%), those who will take it if required (about 10%) and the remaining 10% who are not prepared to take it at all.

The key question is: when will excess US vaccines become available to potentially direct to other countries.

Now that supply has ramped up, the US should have enough to fully vaccinate 335 million people by May and 395 million by June.

While the US is likely to stockpile a large amount for top-ups, there should be significant scope to direct vaccines to countries in need. This development could emerge in the next two months — and could see a very positive shift in sentiment.

In summary, while the near-term surge in cases is concerning, and weighs on growth expectations, the good news is:

- Overwhelming evidence that vaccines work

- The supply chain is ramping up materially

- Current concerns may be resolved in a few months

Economics and policy outlook

US media coverage last week focused on proposed increases to income and capital gains tax as part of the Biden Administration’s American Families package. Details will be put to Congress this week.

Tax hikes are not new news – they were first outlined in Biden’s presidential campaign. The reality is, this is the much more controversial part of Biden’s plan and will encounter a much tougher passage through Congress.

While tax hikes should emerge, they are likely to be smaller than the proposed numbers.

A subtle but important point: it is becoming evident that the prescription drug pricing package will not be included in the American Families Plan. This is likely to be addressed in a separate bill, which is a positive for health care companies.

Markets

US reporting season has been very strong. S&P 500 earnings have continue to see upward revisions. The current trajectory suggests the market is on 20x FY22 earnings. This is full, but much less demanding than the 24x we had been running at.

There is a reasonable potential for markets to consolidate in the near term, though we view this as more a pause than a change in trend.

Key market factors:

- Market breadth is very wide with 95% of stocks running above 200-day moving average. As we have pointed out recently, this is typically positive for the medium-term outlook and argues against a material correction. But history suggests a period of consolidation is likely with this many stocks doing well.

- Sentiment indicators are very positive. Again, this is not a reason for a major reversal, but it leaves the market vulnerable to marginal bad news.

- The market rebound is tracking very closely to the post-recession experience in 2009-10 and 1982-84. In both cases a consolidation tended to occur 12-15 months after the trough.

- Economic momentum is now so strong that there is some risk of a near-term fade affecting sentiment. Again, based on history, near-term S&P 500 market performance has been muted following periods when the ISM Manufacturing index has been at its strongest levels.

The one caveat here is that we are in unchartered waters given low rates, strong growth and the shift in policy. However at this point we see some near-term consolidation as the most likely outcome.

In another healthy sign, we are seeing speculative froth ease off. Indicators such as the Tesla stock price, IPO and renewable energy ETFs and speculative tech names have all rolled over since early February.

The crypto space had been holding up, but there are signs the Coinbase IPO may have marked a peak – at least in the near term. Bitcoin peaked at about US$64K on the same day and is $52K at the time of writing.

Our sense is that liquidity, which is still abundant, is being deployed into the real economy. This is a positive sign and supportive of recovery.

Overall markets were quiet last week with bond yields and equities effectively flat. It’s interesting to note that commodity prices are holding up despite the fall in bond yields in recent weeks.

Iron ore, for example, was up 4.4% for the week and 12.8% month-to-date. This suggests bonds are being bought for portfolio insurance, rather than on a prevailing view that growth is about to disappoint.

About Crispin Murray and Pendal Focus Australian Share Fund

Crispin Murray is Pendal’s Head of Equities. He has more than 27 years of investment experience and leads one of the largest equities teams in Australia.

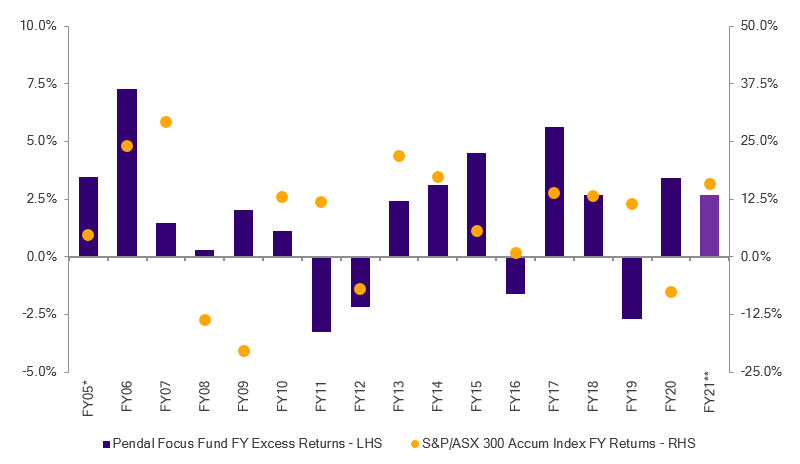

Crispin’s Pendal Focus Australian Share Fund has beaten the benchmark in 12 years of its 16-year history (after fees), across a range of market conditions , as this graph shows:

Source: Pendal. Performance is after fees and before taxes. *From 01 Apr 05; **as at 28 Feb 21. Past performance is not a reliable indicator of future performance.

Pendal is an independent, global investment management business focused on delivering superior investment returns for our clients through active management.

This article has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and the information contained within is current as at April 26, 2021. It is not to be published, or otherwise made available to any person other than the party to whom it is provided.

PFSL is the responsible entity and issuer of units in the Pendal Focus Australian Share Fund (Fund) ARSN: 113 232 812. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1800 813 886 or visiting www.pendalgroup.com. You should obtain and consider the PDS before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested.

This article is for general information purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information in this article may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information in this article is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance.

Any projections contained in this article are predictive and should not be relied upon when making an investment decision or recommendation. While we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.